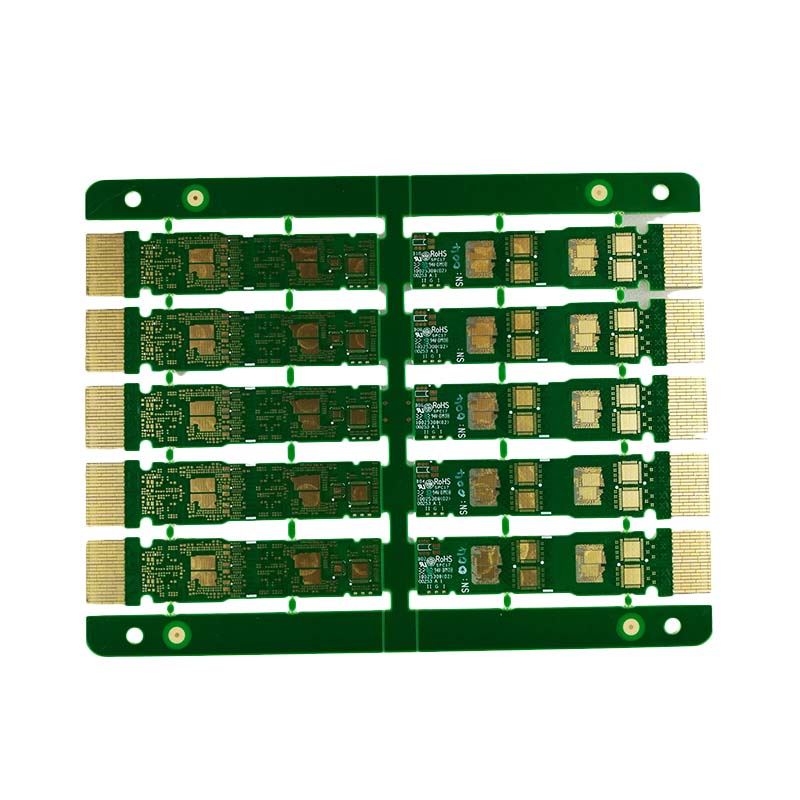

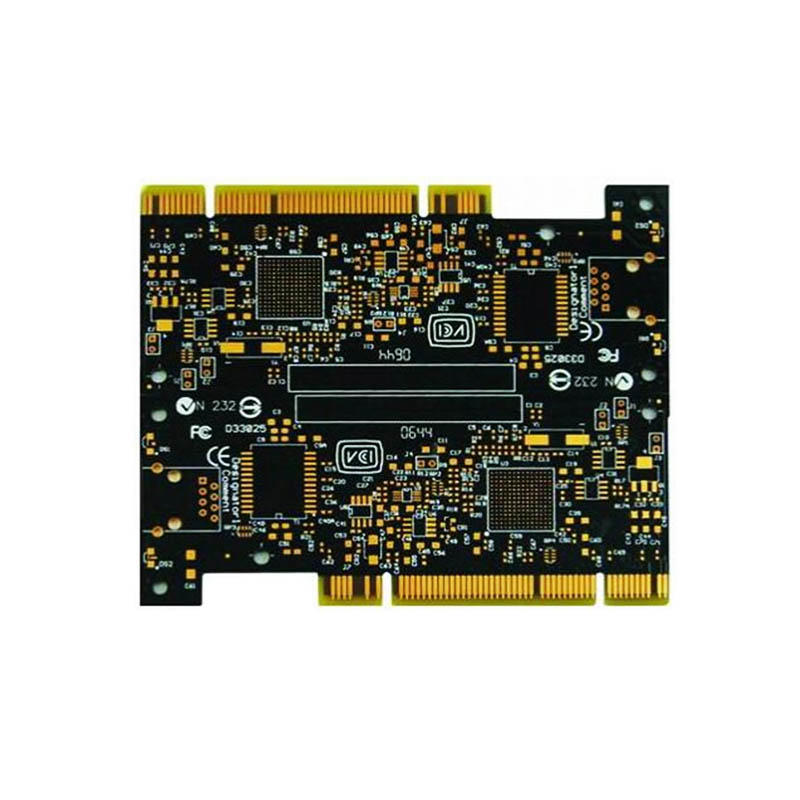

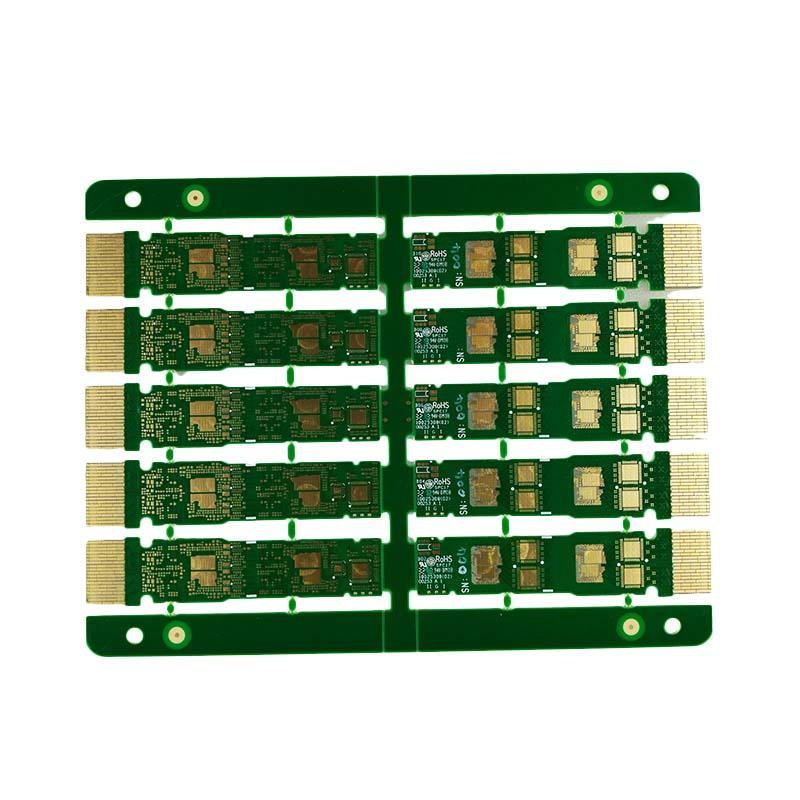

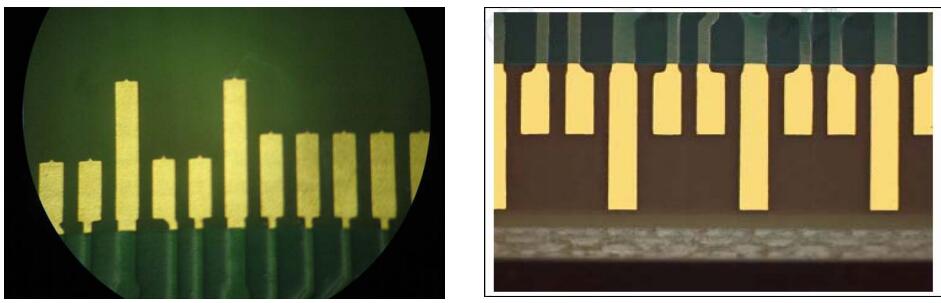

LED lighting is widely used not only for indoor and outdoor illumination, mobile phone backlight modules, and automotive turn signals but also for high-power projection lights, streetlights, high-intensity lighting, large-size backlight modules, and automotive headlights. These advancements are attributed to the continuous progress in LED technology in recent years, leading to the development of more efficient LED components. With advantages such as energy efficiency, environmental friendliness, and long lifespan, LED light sources have become a mainstream trend.To achieve higher brightness, LEDs require increased power input. However, the wall-plug efficiency (WPE) of high-power LEDs remains limited, typically ranging from 15% to 25%. This means that only a fraction of the input power is converted into light, while the majority is dissipated as heat. Due to the extremely small size of LED chips (typically 1–2 mm), the heat flux density of high-power LEDs is exceptionally high—often more severe than that of conventional IC components. This significantly raises the junction temperature of the LED chip, leading to overheating issues. Excessive junction temperatures reduce LED brightness, particularly accelerating the degradation of red light. Additionally, they can cause wavelength shifts, affecting color rendering and significantly reducing LED reliability, as illustrated in Figure 1. As a result, thermal management has become a critical bottleneck in LED technology development.Thermal design presents a major challenge and must be carefully considered across multiple levels, including the chip level, package level, PCB level, and system module level, to determine the most effective heat dissipation strategies. For LED lighting products, system-level heat dissipation is often constrained, making effective thermal management at other levels even more crucial.To analyze heat dissipation, a thermal resistance network is constructed from the heat source (chip) to the ambient temperature, as shown in the diagram below. By examining the characteristics and magnitude of each thermal resistance value, the ideal chip temperature can be calculated, and targeted strategies can be implemented to reduce thermal resistance. It is important to note that the diagram consists of a thermal resistance network spanning the chip level, package level, board level (MCPCB), and system level. In practical analysis, a more detailed thermal resistance network can be established based on the system structure, incorporating factors such as the thermal resistance of die-attach solder or the thermal resistance of heat dissipation module structures. Thermal Management Design: Chip-Level, Package-Level, and Metal Core PCB Since the sapphire substrate of LED chips has poor thermal conductivity, it leads to a high junction-to-substrate thermal resistance (Rjs) in the thermal resistance network shown in the diagram. To address this issue, high-thermal-conductivity materials such as copper can be used to replace sapphire, or a flip-chip design can be adopted to remove the substrate from the heat transfer path, thereby reducing thermal resistance.Currently, some of the most effective thermal management designs at the chip-to-package level include the use of co-fused alloy substrates and flip-chip configurations, which facilitate efficient heat transfer from the chip to the package. Another feasible approach is increasing the chip size to lower heat flux density.At the package level, advanced thermal design techniques involve using high-thermal-conductivity metal heat sinks (such as aluminum and copper), as illustrated in Figure 2, as well as high-thermal-conductivity ceramic substrates (such as AlN and SiC). These solutions allow heat to dissipate rapidly from the chip, effectively reducing the package-level thermal resistance (Rsc).At the PCB level, the main difference from traditional PCB designs lies in the significantly higher heat flux density of LEDs. Conventional FR4 + copper foil structures have limited heat dissipation capabilities, making them inadequate for high-power LEDs. To address this, a thicker metal layer is used to reduce spreading resistance, a structure known as Metal Core PCB (MCPCB). The basic structure of the MCPCB (Metal Core PCB) is shown in Figure 3, which includes a thick metal layer, a dielectric layer, and a copper foil layer. It further spreads the heat from the package and rapidly transfers it to the heat dissipation components of the system module, thereby reducing the thermal resistance value (Rcb)Figure 3 MCPCB structure diagramTo reduce component thermal resistance, some current designs adopt a Chip-on-Board (COB) approach, where LED chips are mounted directly onto the Metal Core PCB (MCPCB). This eliminates the thermal resistance of packaging materials and solder interface layers, thereby improving heat dissipation. Many companies (e.g., Lamina Inc., Citizen Inc., OSRAM Inc., Avago Technologies) have adopted this design in their products. However, this approach introduces challenges in optical design and raises reliability concerns in manufacturing, making the overall design more complex. Thermal Design of LED Heat Dissipation ModulesThe thermal design of LED heat dissipation modules is critical to ensuring the efficiency and stability of LED lighting systems, as approximately 70-80% of the electrical energy input into an LED is converted into heat. Poor heat dissipation can lead to an increase in LED chip junction temperature, resulting in luminous decay, color shift, reduced lifespan, or even failure. The key aspects of LED heat dissipation module design are as follows: Heat Transfer Pathway: Heat travels from the LED chip → substrate (metal-core PCB) → heat sink → ambient air. It is essential to ensure high thermal conductivity at each stage. Low Thermal Resistance Design: To enhance heat dissipation, the thermal pathway should be minimized, and high thermal conductivity materials (such as copper, aluminum, and graphene) should be used. Additionally, thermal interface resistance should be reduced by filling gaps with thermal grease or thermal pads. Unlike general electronic devices, which typically have ventilation openings that allow PCBs to dissipate heat through convection and radiation, many LED lighting products are enclosed, limiting their heat dissipation capacity. Since the ability of the heat dissipation module to remove heat is closely related to its design, key design strategies include increasing the surface area in contact with air, enhancing convection coefficients, and improving radiative heat dissipation. In lighting applications, additional constraints arise due to factors such as mechanical structure compatibility with traditional lamp designs (e.g., MR16), weight limitations, and outdoor protection requirements (such as dustproof and waterproof ratings—IP standards). These constraints further restrict thermal design flexibility, making optimization a crucial aspect of LED heat dissipation design. Common heat dissipation molds on the marketThermal Design of LED Heat Dissipation ModulesThe thermal design of LED heat dissipation modules is critical to ensuring the efficiency and stability of LED lighting systems, as approximately 70-80% of the electrical energy input into an LED is converted into heat. Poor heat dissipation can lead to an increase in LED chip junction temperature, resulting in luminous decay, color shift, reduced lifespan, or even failure. The key aspects of LED heat dissipation module design are as follows: Heat Transfer Pathway: Heat travels from the LED chip → substrate (metal-core PCB) → heat sink → ambient air. It is essential to ensure high thermal conductivity at each stage. Low Thermal Resistance Design: To enhance heat dissipation, the thermal pathway should be minimized, and high thermal conductivity materials (such as copper, aluminum, and graphene) should be used. Additionally, thermal interface resistance should be reduced by filling gaps with thermal grease or thermal pads. Unlike general electronic devices, which typically have ventilation openings that allow PCBs to dissipate heat through convection and radiation, many LED lighting products are enclosed, limiting their heat dissipation capacity. Since the ability of the heat dissipation module to remove heat is closely related to its design, key design strategies include increasing the surface area in contact with air, enhancing convection coefficients, and improving radiative heat dissipation. In lighting applications, additional constraints arise due to factors such as mechanical structure compatibility with traditional lamp designs (e.g., MR16), weight limitations, and outdoor protection requirements (such as dustproof and waterproof ratings—IP standards). These constraints further restrict thermal design flexibility, making optimization a crucial aspect of LED heat dissipation design. Challenges and Breakthroughs in LED LightingWith the advancement of multi-spectral LED lighting, there is growing emphasis on energy-efficient lighting, health-conscious lighting, and ecological lighting. The ideal solution is to mimic natural sunlight, a goal that can be achieved using LED technology, albeit with several technical challenges. Future innovations may integrate AI-driven algorithms to dynamically adjust thermal management strategies, such as modulating fan speed or controlling thermoelectric module power. Additionally, new designs may integrate heat dissipation structures with LED packaging (e.g.,COB-integrated thermoelectric cooling), leading to more compact and efficient lighting solutions. The development potential of LED lighting technology remains vast. Continued efforts must focus on enhancing energy efficiency and power output. On the application side, lamp design innovation should be actively pursued while expanding into new fields such as smart lighting, non-visual lighting, and high-definition displays. The ultimate technological goal is to achieve natural light illumination, providing people with an energy-efficient, healthy, and comfortable lighting environment.

Read More>>